Section 179 Tax Deduction: Why Smart Business Owners Buy Equipment

If you've been putting off that equipment purchase, the end of the year might be the perfect time to pull the trigger. Thanks to Section 179 of the IRS tax code, businesses can write off the full purchase price of qualifying equipment in the year it's bought and put into service. For construction companies, landscapers, contractors, and other equipment-dependent businesses across Arizona, this tax benefit can save thousands of dollars.

What Is Section 179?

Section 179 is a tax incentive designed to encourage businesses to invest in themselves by purchasing equipment, vehicles, and machinery. Instead of depreciating an asset over five, seven, or more years, Section 179 allows you to deduct the entire purchase price from your gross income for the current tax year.

For the 2025 tax year, businesses can deduct up to $2,500,000 in qualifying equipment purchases, with a phase-out threshold beginning at $4,000,000 in total equipment purchases. Thanks to the One Big Beautiful Bill Act enacted in 2025, these limits have doubled from earlier in the year, giving businesses even more opportunity to invest in growth. This means if your business buys a new excavator, skid steer, tractor, or any qualifying construction equipment before December 31st, 2025, you can potentially deduct the full amount from your 2025 taxes.

What Equipment Qualifies for Section 179?

The good news for equipment buyers is that most heavy machinery and construction equipment qualifies. This includes:

- Excavators and backhoes

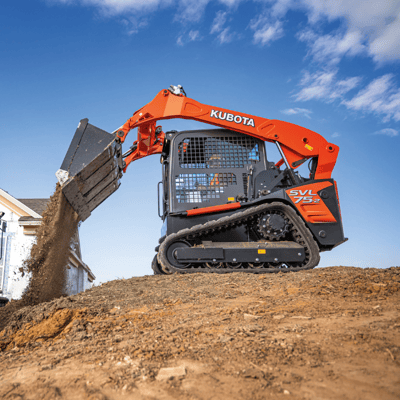

- Skid steers and track loaders

- Compact tractors and utility tractors

- Wheel loaders and dozers

- Dump trucks and service vehicles

- Attachments and implements

- Forklifts and telehandlers

The equipment must be purchased (not leased in most cases) and put into service during the tax year you're claiming the deduction. "Put into service" simply means the equipment is ready and available for use in your business—it doesn't need to be used extensively, just available for business purposes.

Real-World Example: How Much Can You Save?

Let's say you purchase a Kubota excavator for $80,000 in December 2025. Without Section 179, you'd depreciate that purchase over several years, deducting only a portion each year. With Section 179, you can deduct the full $80,000 from your 2025 taxable income.

If your business is in the 24% federal tax bracket, that's a potential tax savings of $19,200 in the first year alone. State tax savings could add even more. That's real money that stays in your business instead of going to taxes.

Why Buy Before December 31st?

Timing matters with Section 179. To claim the deduction for 2025, you must:

- Purchase the equipment by December 31st, 2025

- Put it into service by December 31st, 2025

Even if you finance the equipment, you can still take the full deduction in the year of purchase. The IRS doesn't require you to pay cash—financed equipment qualifies as long as it meets the other requirements.

Waiting until January means you'll have to wait an entire year to see those tax benefits. For businesses with strong 2025 earnings, buying before year-end can significantly reduce your tax liability.

Additional Tax Benefits: 100% Bonus Depreciation

The One Big Beautiful Bill Act also introduced permanent 100% bonus depreciation for "qualified production property" acquired and placed in service after January 19, 2025. This can provide additional first-year deductions beyond Section 179 for qualifying equipment purchases.

For businesses making larger equipment investments, the combination of the increased Section 179 limits and bonus depreciation creates unprecedented opportunities for tax savings. Your tax advisor can help you determine the best strategy for maximizing both deductions based on your specific business situation and the timing of your equipment purchases.

Important Considerations

While Section 179 offers substantial benefits, there are a few things to keep in mind:

Income Limits: The deduction cannot exceed your business's taxable income for the year. If your deduction is larger than your income, you can carry forward the excess to future years.

Business Use: The equipment must be used for business purposes more than 50% of the time to qualify.

Consult Your Tax Professional: Tax laws are complex and change regularly. Always consult with your accountant or tax advisor to understand how Section 179 applies to your specific situation and to ensure you're maximizing your available deductions.

Make Your Move Before Year-End

If you've been considering new construction equipment, compact tractors, or other machinery for your business, now is the time to act. Section 179 can turn a major capital expense into a smart tax strategy, helping you upgrade your fleet while keeping more money in your business.

At Bingham Equipment, we help Arizona businesses across Phoenix, Tucson, Mesa, and throughout the state find the right equipment to grow their operations. Our team understands the urgency of year-end purchases and can work quickly to get you the equipment you need before December 31st.

Ready to take advantage of Section 179? Contact Bingham Equipment today to explore our inventory of Kubota, Bobcat, Case, and New Holland construction equipment, tractors, and more. Let's make your year-end equipment purchase work harder for your business.

Disclaimer: This article is for informational purposes only and should not be considered tax advice. Please consult with a qualified tax professional regarding your specific situation and eligibility for Section 179 deductions.